payment plan for mississippi state taxes

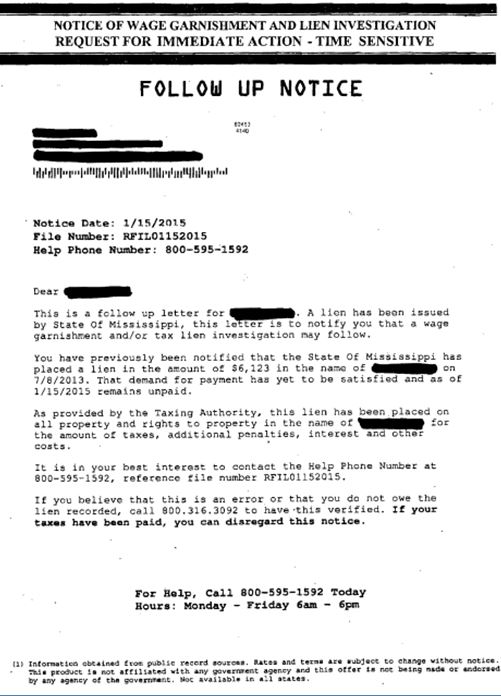

If you live in mississippi. The time frame or duration of the installment agreement can be longer than 12-24 months depending upon.

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Mississippis income tax ranges between 3 and 5.

. The general consensus is that the hastily devised plan to eliminate Mississippis income tax and replace it with higher sales taxes will die f RUSS LATINO. Pay by credit card or e-check. But since Mississippi does not require retirees to pay.

Mississippi does not have some of the tax credits common to other states such as the Earned Income Tax Credit or the Child and Dependent Care Tax Credit. There is an additional convenience fee to pay through the msgov portal. John is filing as a single taxpayer in Mississippi.

Payment plan for mississippi state taxes. Mississippi State University PO Box 5328 158 Garner Hall 88 Garner Circle Barr Avenue Mississippi State MS 39762 Mailstop. If the proposal is passed the bill would immediately eliminate income tax for people making less than 50000 a year or 100000 for married filers and income tax would be completely phased out by 2030.

There are several options available. Under the Mississippi Tax Freedom Act of 2022 the first 10000 of a taxpayers income will not be taxed but any additional income will be taxed at a rate of 5 in 2023. Further the general sales tax rate would jump.

Mississippi is trending towards ending personal income tax and increasing state sales tax. The state uses a simple formula to determine how much someone owes. Payment plans are generally 12-24 months and require manager approval.

Prepare Your 2021 2022 Mississippi State Taxes Online Now. Mississippi income tax rate. If you make a non-qualified withdrawal however the earnings portion will be taxable to a resident recipient.

His annual taxable income is 23000. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or.

Mississippis State Tax Payment Plan or Installment Agreement. Welcome to The Mississippi Department of Revenue The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. If someone makes less than 5000 they pay a minimum.

Lets take a look at an example provided by the Mississippi Department of Revenue. Funds are not taxed until you withdraw money from the plan. How to Make a Credit Card Payment Income.

Mississippi State Tax Payment Plan Details

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

/cloudfront-us-east-1.images.arcpublishing.com/gray/HGN7HWM6KVG7XKH4G6LK4HQHQY.jpg)

House Passes Tax Reform Plan Bill Heads To Senate

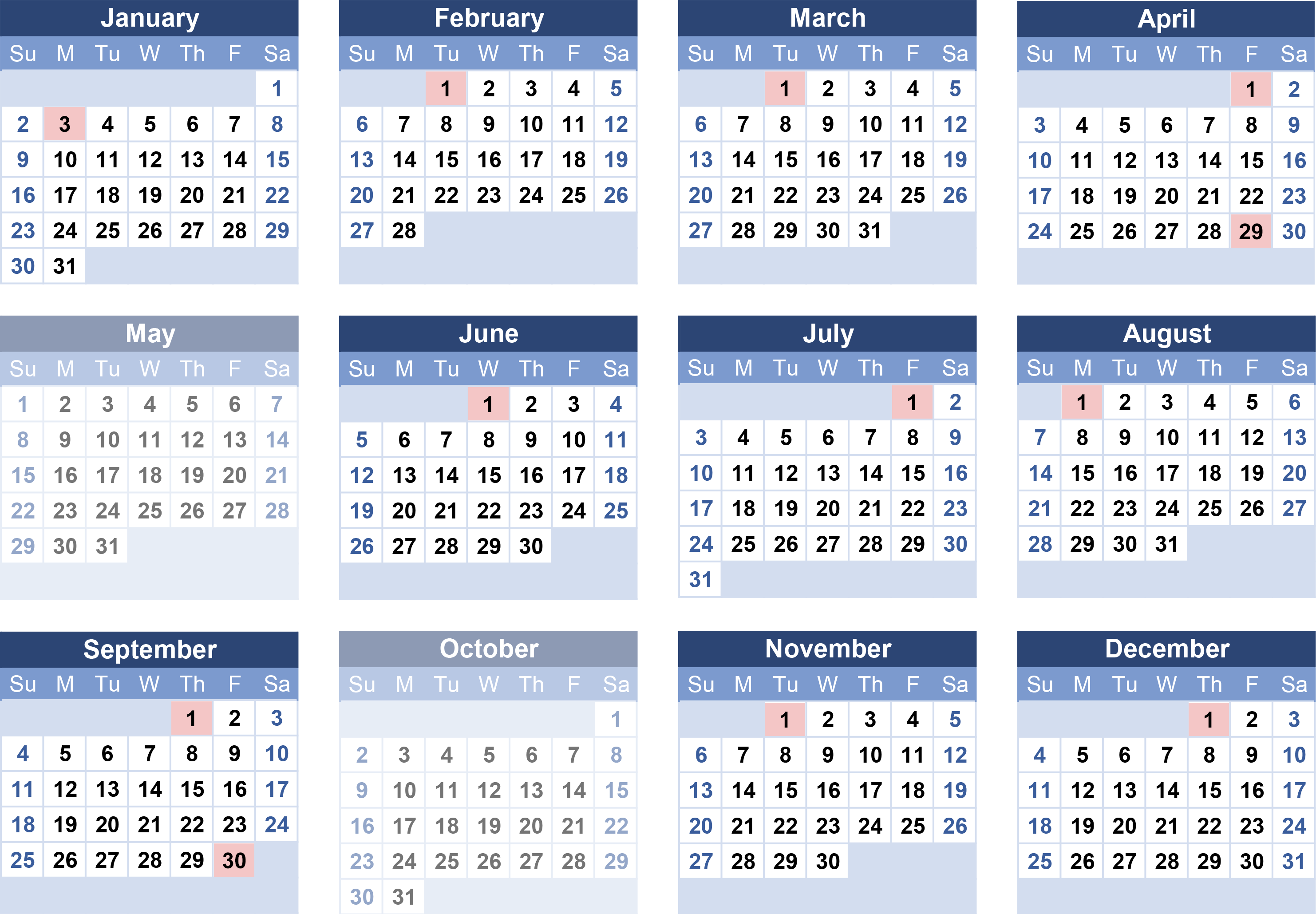

Opers Benefit Payment Schedule

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

State Conformity To Cares Act American Rescue Plan Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Mississippi Income Tax Reform Details Evaluation Tax Foundation

Mississippi Retirement Tax Friendliness Smartasset

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today

Inside The Income Tax Cut Battle Between House And Senate Leaders The Sun Sentinel

The New Irs Payment Plan For People Who Owe Large Tax Debts Non Streamlined Installment Agreements Jackson Hewitt

Reeves Likes Pieces Of The Two Tax Plans Breezynews Com Kosciusko News 24 7

Mississippi Speaker Of The House Asks Business Leaders To Back His Plan To Remove State Income Tax

Utility Payment Plans Utility Payments And Services Citybase

Free Rent Payment Plan Template Faqs Rocket Lawyer

Mflex Mississippi Flexible Incentive Plan Mighty Mississippi

Mississippi Is The First State To Confirm It Will Tax Forgiven Student Loan Debt With More Waiting In The Wings Business Insider Africa